Three months into the year and interest rates continue to fluctuate. In January it seemed like rates were heading downward steadily. February saw an increase in rates. The banking crisis earlier this month caused rates to adjust downward again. Last year, there was a lot of ink spilled and key strokes dedicated to predicting rates. Most predictions proved to be wrong. At this point, prognostication on rates seems like a fool’s errand. That said, I wanted to talk about one of the better bellwethers for mortgage rates, the ten year treasury bond.

In the financial world, a bellwether is an indicator of something bigger. For the bond market, the ten-year Treasury bond is the go-to indicator of how things are going. When investors are feeling good about the economy, they tend to buy more bonds, which drives down the yield (i.e., interest rate) on the ten-year Treasury bond. Conversely, when things are looking a bit shaky, investors tend to flock to the safety of Treasury bonds, which drives up the yield.

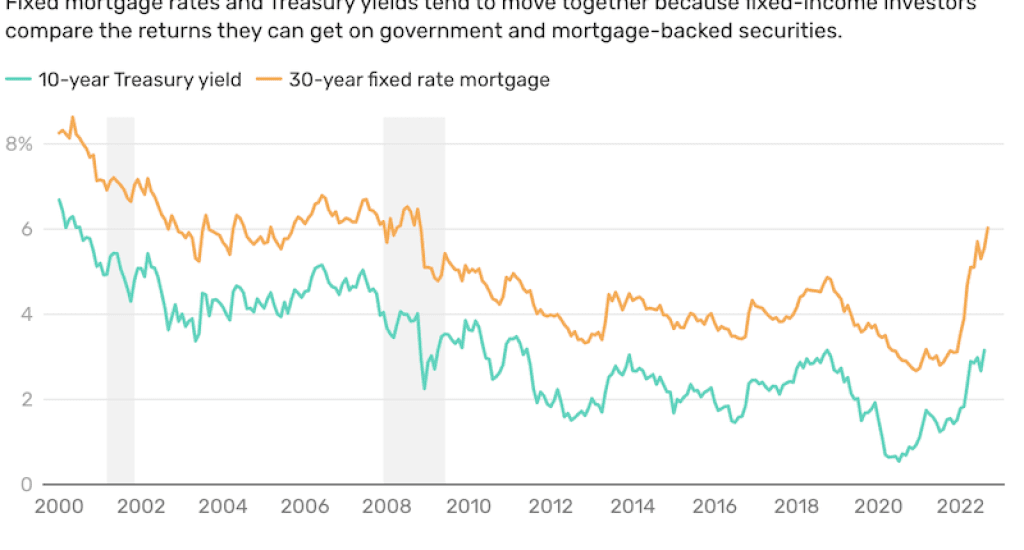

So, what does all of this have to do with mortgage rates? Well, the yield on the ten-year Treasury bond is a key indicator of where mortgage rates are headed. When the yield on the ten-year Treasury bond goes up, so do mortgage rates. When the yield goes down, mortgage rates tend to follow suit.

Think of it like a game of follow the leader, but with money. When the leader (the ten-year Treasury bond) goes up, the followers (mortgage rates) try to keep up. And when the leader goes down, the followers slow down too.

What Does This Mean for Buyers?

Consider this as more of how does this work vs a how to post. I’ve read in some places that following the ten year treasury closely may give buyers a sense of when to lock their mortgage rate. I have to say, I am a little skeptical about that. While the two are closely correlated, there may not be enough lag between the change in treasury bond yields and the change in mortgage rates. It’s a pretty busy world out there and unless you work in finance, you also may not have the time to closely monitor treasuries. This is where I would lean on a knowledgeable mortgage professional rather than tracking things yourself. Let your mortgage professional give you guidance on when to lock your rate.